STANDARD DEVIATION Calculator for Nifty, BankNifty, All F&O NSE Stocks.

CLICK TO VIEW TODAY’S STANDARD DEVIATION LEVELS.

Nifty Standard Deviation Calculator, description.

Price = Current Market Price.

Values for 3 ,2 & 1 Levels Of Standard Deviation Below Yesterday’s Closing Price.

Values for 1, 2 & 3 Levels Of Standard Deviation Above Yesterday’s Closing Price.

Colors Track The Movement Of Price Across These Levels.

USEFUL OBSERVATION FOR DAYTRADING, WHILE USING THIS Standard Deviation Screening TOOL.

1) The Probability of a stock reaching its 2nd Standard Deviation Level during intraday is VERY LESS. This helps you plan for meaningful targets and stop-losses when placing bracket or cover orders.

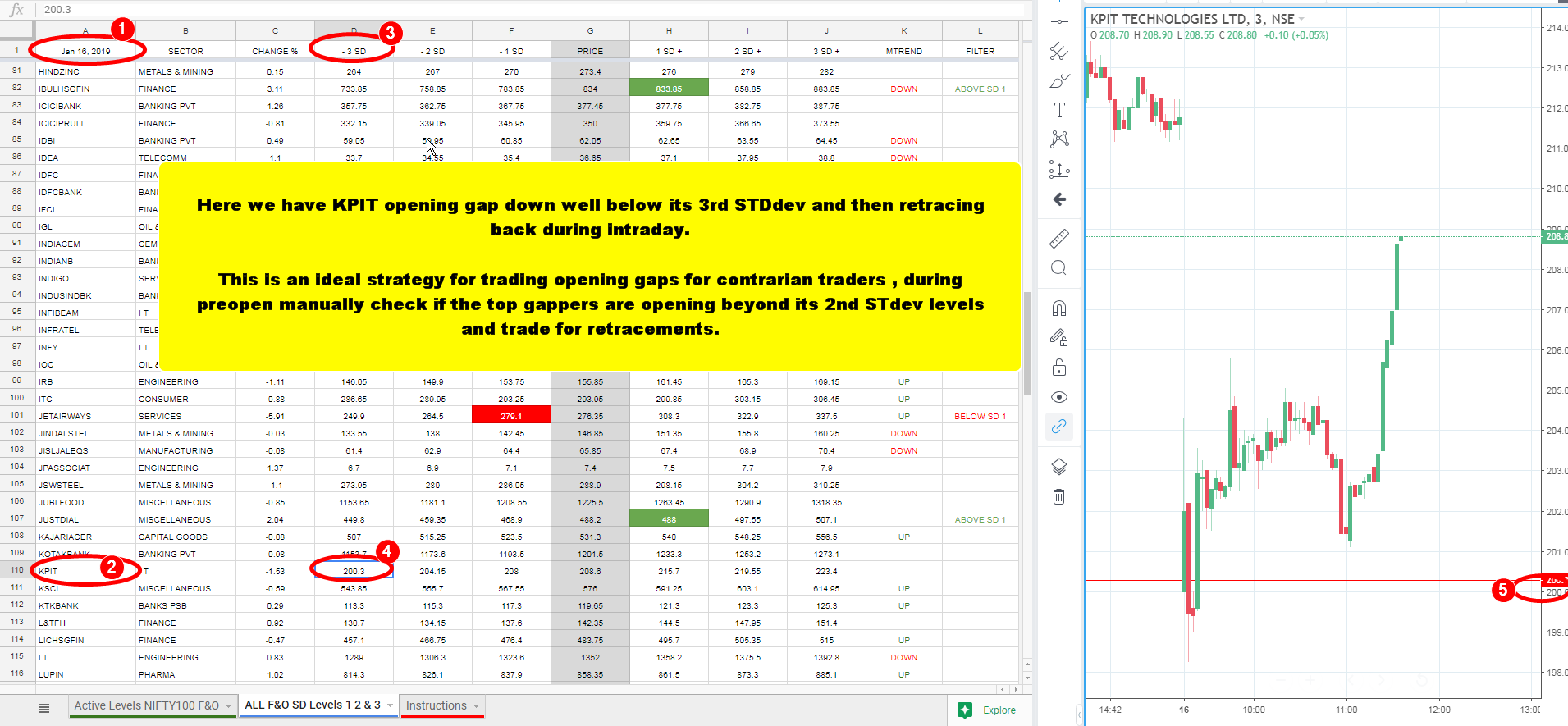

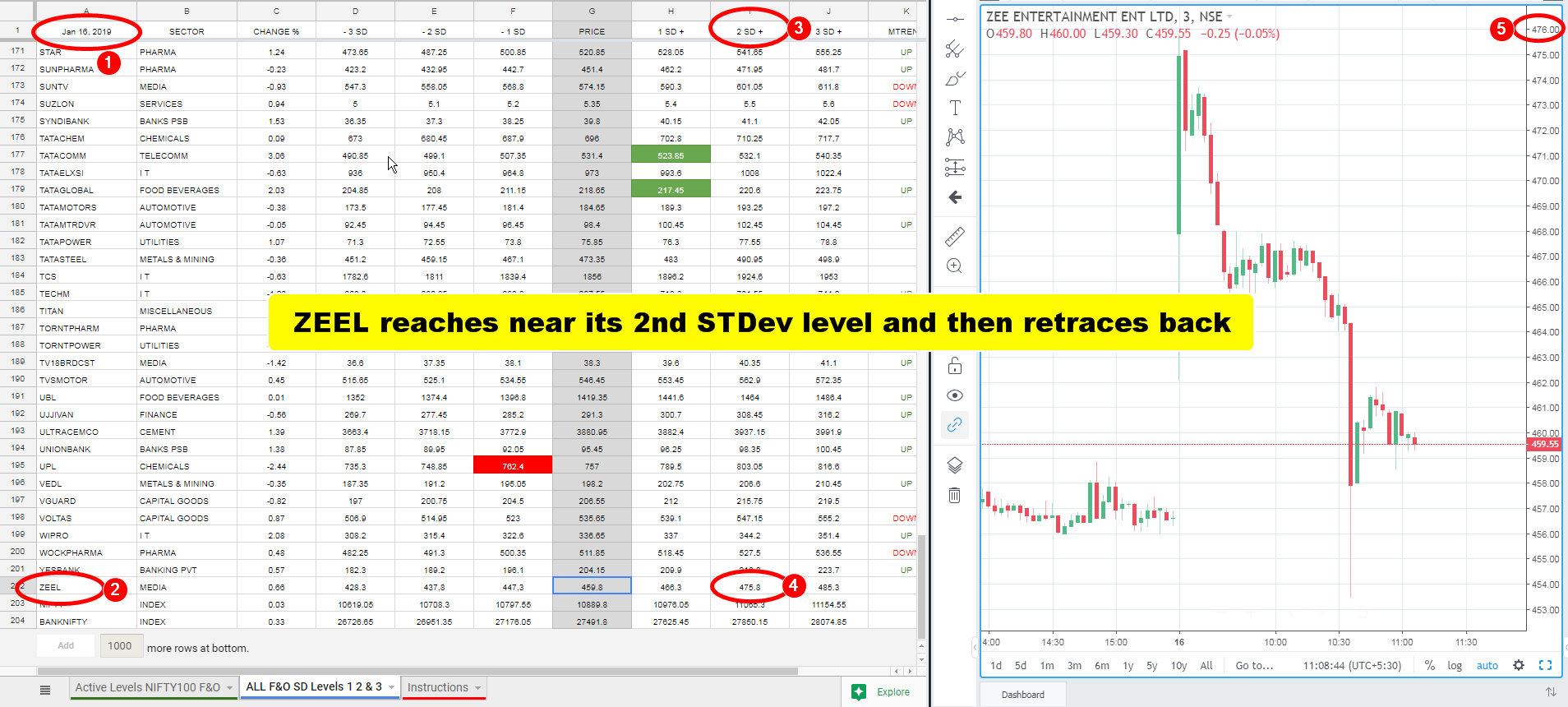

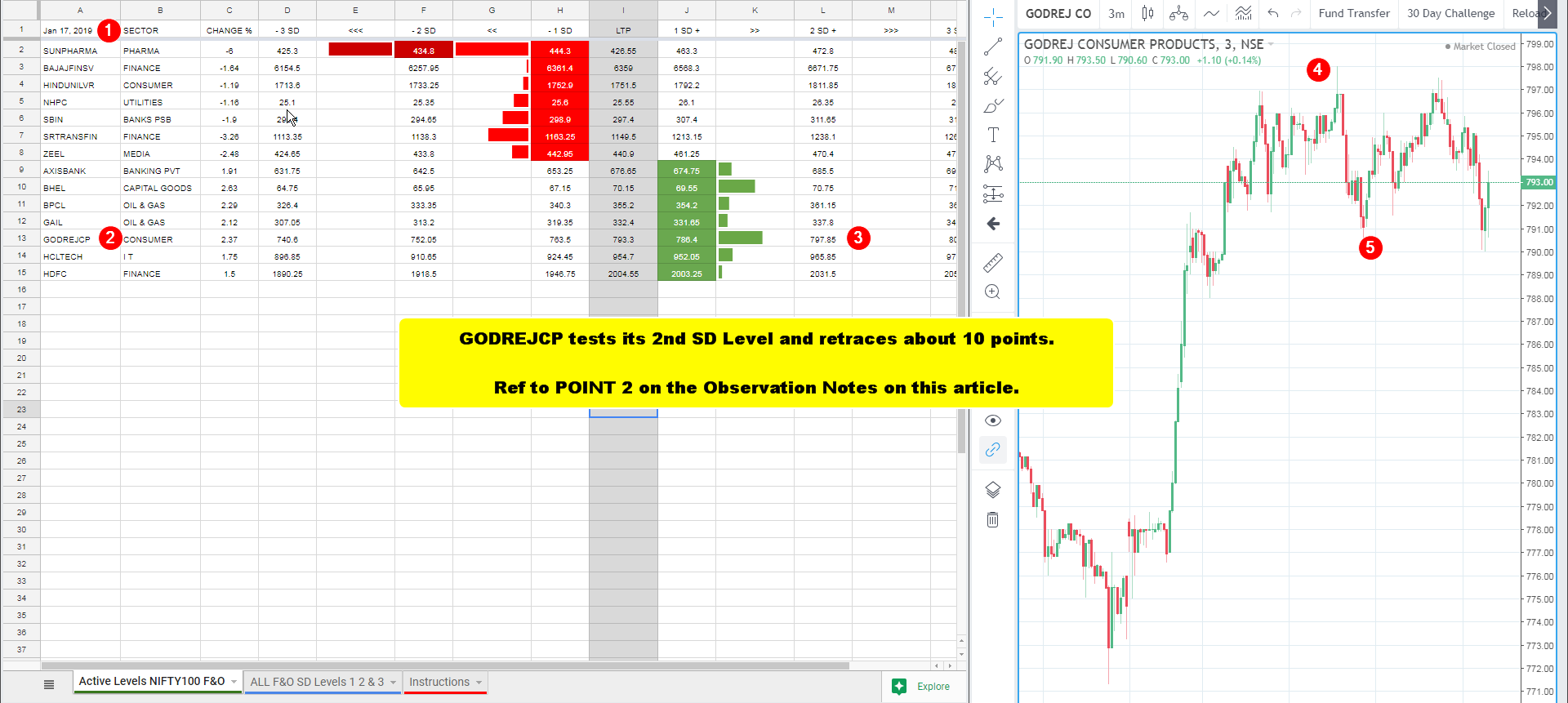

2) In cases, where a stock moves beyond its 2nd Standard Deviation level in the morning session, it has a higher probability of retracing to its 1st Standard Deviation level on the same side during the day.

3) Such stocks that has moved beyond SD Level 2 in the morning session, then retraces back to above SD Level 1 and stays there, has a higher probability of re-testing SD Level 2 again in the noon session.

4) If a group of stocks FROM THE SAME SECTOR are trading above or below its 1st Standard Deviation Level for a while, it has a higher probability of continuing in the same direction further.

5) When a group of stocks FROM THE SAME SECTOR are trading above or below its 1st Standard Deviation level, this shows a fundamental strength or weakness in the sector for the day. Use this information to identify the rest of the stocks from the same sector that are yet to mirror this sector-wise bias. This helps you trade bigger intraday moves on time.

6) A stock closing above its Positive 2nd Standard Deviation level, is an ideal stock for BTST traders.

7) Preferably stick to just the NIFTY 100 F&O Stocks when using Standard Deviation based daytrading methods.

Why is Standard Deviation Levels Used for in DayTrading ?

Standard deviation levels helps daytraders to plan for meaningful targets and stop-loss for intraday trading and is also used by contrarian intraday traders for mean reversion trading.

Who is standard deviation based DayTrading useful for ?

Standard Deviation based daytrading is ideally useful for daytraders,

- Who don’t like the noise created by technical indicators and wants to trade based on just the statistical probability of numbers.

- Who has overloaded themselves with too much technical indicator knowledge and still finds it useless.

- Who needs a fresh start with a whole new technique, that requires very less effort.

Standard deviation based daytrading consumes less than 1/3rd of the energy in comparison to finding success through traditional technical indicator based trading.

If you have heard the saying, less is more in daytrading, probably this is what they are talking about.

PLEASE WATCH THE BELOW VIDEO TO LEARN MORE ON THE CONCEPT OF STANDARD DEVIATION IN STOCK TRADING.

INTERESTING OBSERVATIONS ON PRICE REACTION TO STANDARD DEVIATION LEVELS DURING INTRADAY.

(These examples are not to be taken conclusively, but use these INTRADAY data points for your own research into this subject.)

Please note: If you subscribe to the STANDARD DEVIATION Calculator premium version, it may take up to 12 hours for the activation email with your access link to be processed and sent. Remember to check your spam folder, as the email might be delivered there. If you haven’t received the activation email after 12 hours, please send a reminder to [email protected] .