The Bombay Stock Exchange (BSE), a prominent stock exchange in India, has recently introduced futures and options contracts for their benchmark index known as the Sensex. This strategic move has garnered substantial attention from retail investors in India’s financial markets. Particularly, there has been a growing fascination and engagement with trading activities centered around the Sensex options instrument. This surge in interest is fueled by the potential for profit and risk management that options trading offers.

A notable outcome of this development is the significant increase in trading volume within the Sensex options market. This surge in trading activity has contributed to heightened liquidity levels, which is crucial for the smooth functioning of financial markets. The heightened liquidity, in turn, plays a pivotal role in reducing instances of slippage. Slippage refers to the situation where an order is executed at a different price than expected due to a lack of market depth or liquidity, potentially leading to less favorable trading outcomes.

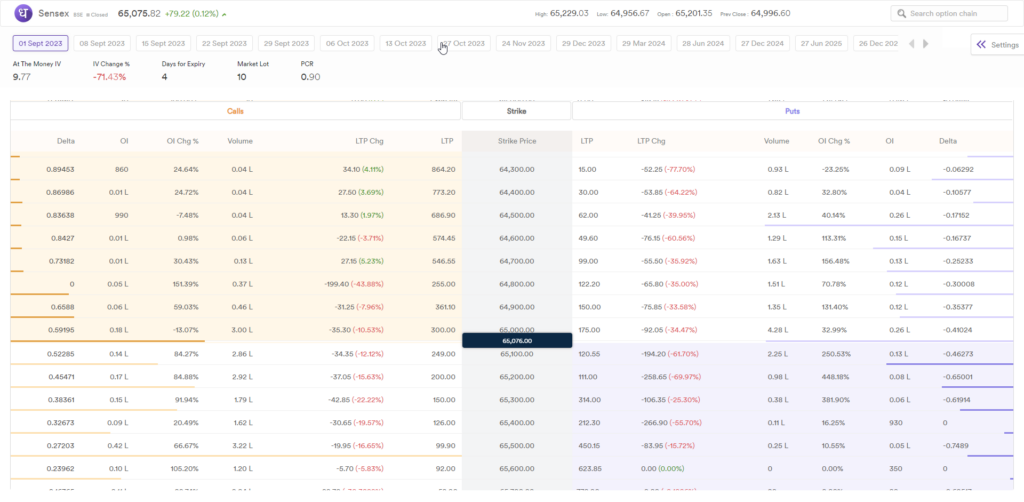

Dhan’s options trader platform has emerged as a key player in facilitating the engagement of traders with the Sensex options market. This platform offers a comprehensive suite of tools and features that empower traders to access and analyze the Sensex option chain. The option chain is a visual representation of all available options contracts for a particular underlying asset, in this case, the Sensex index. By providing users with the ability to view the Sensex option chain, Dhan’s options trader platform empowers traders to make informed decisions based on a comprehensive understanding of available options, strike prices, and expiration dates.