If you’re trading intraday positions on Shoonya, you’ve probably wondered about their auto square-off timings—especially if you’ve used other brokers where getting force-closed early in the day can be frustrating.

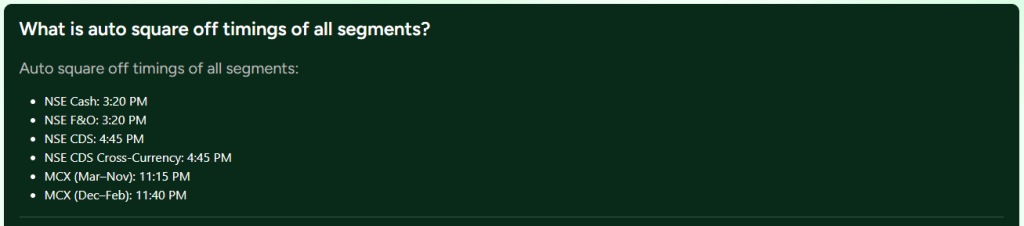

Shoonya’s policy is straightforward: they square off open intraday positions at 3:20 PM for both NSE Cash and F&O segments. More importantly, they don’t charge you separately for this auto square-off.

What This Actually Means

Most brokers square off intraday positions somewhere between 3:15 PM and 3:30 PM. The logic is simple—they need a buffer before market close at 3:30 PM to ensure all positions are closed out and there’s no risk of delivery obligations or margin shortfalls.

Shoonya sits right in the middle at 3:20 PM, which gives you the full trading session without cutting things too close to the wire. If you’re someone who holds positions till the last minute hoping for a late-session move, you get access to most of the day’s action.

The no-extra-charge part matters because some brokers levy a small fee for auto square-off, treating it as an administrative action. Shoonya doesn’t. If your position gets squared off automatically, you just pay the usual brokerage and transaction costs—nothing on top.

Who Benefits from This

This setup works well if you’re an active intraday trader who likes to manage positions manually but occasionally forgets to exit. You get that automatic exit without worrying about penalty charges piling up.

It’s particularly useful if you’re the type who sets up trades in the morning, places stop-loss orders, and then steps away for a few hours. Maybe you’re tired by noon, or you have work commitments that pull you away from the screen. With Shoonya’s policy, you can let your positions and stop-losses run without constantly checking the clock or worrying about surprise square-off charges if the broker closes you out. You know exactly when the exit will happen, and you know there’s no extra fee attached.

How It Compares

Compared to other brokers, the 3:20 PM timing for F&O and Cash segments is fairly common. For example:

- Zerodha generally has an auto square-off time of 3:25 PM for Equity Cash and 3:26 PM for Equity F&O, though some sources also mention 3:15 PM for Equity and 3:20 PM or 3:25 PM for F&O, with charges of ₹50 + 18% GST per order.

- Groww typically starts its auto square-off process at 3:10 PM for intraday positions and 3:20 PM for F&O intraday positions, charging ₹50 + GST per position.

- Upstox usually squares off equity and F&O positions at 3:15 PM, with auto square-off charges of ₹50 + 18% GST per order.

- Angel One has an auto square-off time of 3:15 PM and charges ₹20 per executed order for auto square-off.

- ICICI Direct may square off intraday positions any time after 3:15 PM and applies system square-off charges of ₹50 per order (capped at ₹100 per day) for commodities, with other sources mentioning additional fees for auto square-off.

- Kotak Securities auto squares off equity positions at 3:20 PM and charges ₹49 per order for auto square-off.

- Paytm Money typically squares off intraday orders automatically between 3:15 PM and 3:30 PM, with auto square-off charges of ₹20 + GST per position.

- Sharekhan has an auto square-off time of 3:11 PM and charges ₹50 per order.

- Fyers generally initiates auto square-off for Equity & F&O at 3:15 PM, charging ₹50 + 18% GST per executed order. Some sources also state ₹20 per order.

The crucial differentiator for Shoonya, as mentioned, is the explicit confirmation of no additional charges for their 3:20 PM auto square-off. For many other platforms, auto square-off comes with a penalty.

Disclaimer on Broker Charges and Timings: Please note that the auto square-off timings and charges mentioned for other brokers (Zerodha, Groww, Upstox, Angel One, ICICI Direct, Kotak Securities, Paytm Money, Sharekhan, Fyers) are based on information generally available in the public domain and can be subject to change by the respective brokers. Trading policies, charges, and timings are frequently updated. We highly recommend that you verify the most current and accurate details directly with your broker’s official website or customer support before making any trading decisions.

Practical Takeaway

If you’re already using Shoonya or considering it, the 3:20 PM auto square-off with no extra charges is a small but useful feature. It won’t revolutionize your trading, but it does remove one small friction point—knowing you can let positions run with stop-losses in place without babysitting them or worrying about penalty fees.

Just don’t treat it as a license to ignore your open positions entirely. The closer you get to market close, the harder it can be to exit at favorable prices, especially in illiquid contracts. Use the time wisely, set your stop-losses properly, and let the system do its job if you need to step away.