In the stock market, beta is a measure of the volatility, or systematic risk, of a stock relative to the overall market. Beta is used by investors to gauge the level of risk associated with a particular stock and to help make investment decisions.

Beta is calculated as the covariance of a stock’s returns with the returns of the overall market, divided by the variance of the market returns. A beta of 1 indicates that a stock’s price will move with the market, while a beta less than 1 indicates that the stock is less volatile than the market, and a beta greater than 1 indicates that the stock is more volatile than the market.

For example, if a stock has a beta of 1.5, it is expected to be 50% more volatile than the market. If the market goes up by 1%, the stock is expected to go up by 1.5%. Conversely, if the market goes down by 1%, the stock is expected to go down by 1.5%.

Beta is a useful tool for investors because it allows them to assess the risk-reward trade-off associated with different stocks. Stocks with a high beta tend to offer higher potential returns, but also carry higher risks, while stocks with a low beta tend to be less risky but also offer lower potential returns.

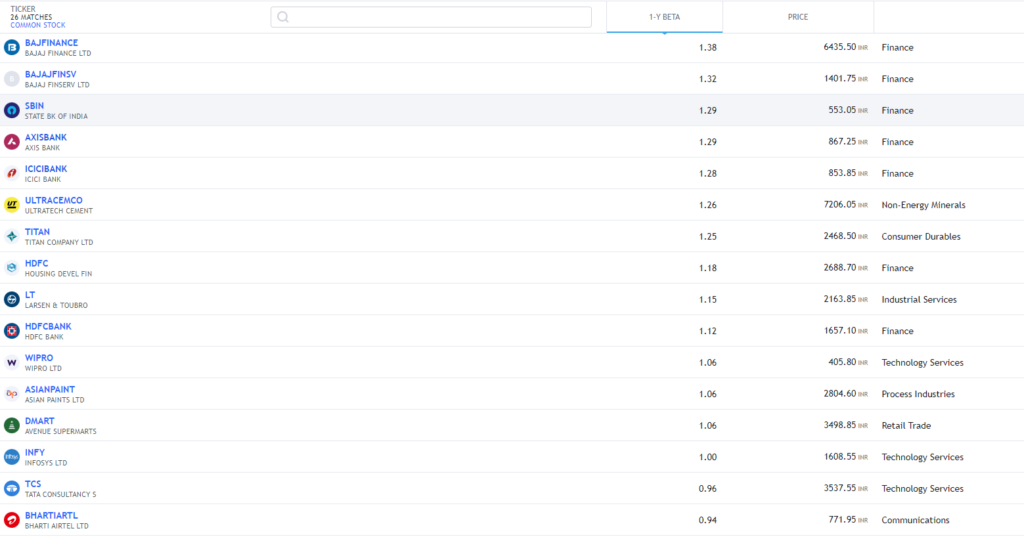

Examples of high beta large cap stocks in India are bajajfinance, bajajfinserve, sbin, axisbank, icicibank, ultracemo, titan etc