[Disclaimer: Brokerage offers and promotional benefits may change without notice. This information is for general awareness only. Please verify current offers, terms, and conditions directly with official sources or customer service before making decisions. All images are the property of their respective brokerage firms.]

Understanding the Opportunity

Let’s talk about what this means for your trading strategy. Traditional margin trading has always come with a catch: while you gain the ability to purchase stocks with only a fraction of the total cost upfront, you pay daily interest on the borrowed amount. It’s a trade-off that many investors accept, but one that can eat into profits, especially for short to medium-term positions.

SBI Securities has essentially removed that barrier for nearly a month of trading activity. For 23 trading days, you can leverage your capital without worrying about interest charges accumulating on your positions.

How the Margin Trading Facility Works

Before we dive deeper into the offer, here’s a quick primer on MTF for those new to the concept. When you use a Margin Trading Facility, you’re only required to put down a portion of the stock’s value—typically between 25% to 50%. Your broker funds the remaining amount, using your cash or securities as collateral.

Here’s a practical example: If you have ₹25,000 and want to invest in stocks worth ₹1,00,000, MTF with 4x leverage makes this possible. You provide the ₹25,000, and the broker lends you the remaining ₹75,000. You own the full position, and when you sell, you repay the borrowed amount and keep the profits (minus any interest and charges).

Under normal circumstances, you would pay daily interest on that ₹75,000 borrowed amount. This is where SBI Securities’ new offer changes the equation.

The PRO Zero Advantage

With the PRO Zero plan, that interest charge disappears for your first 23 trading days. This creates several strategic advantages:

Extended Holding Flexibility: You can hold positions for nearly a month without the pressure of daily interest costs mounting. This gives you more breathing room to let your investment thesis play out.

Cost-Effective Leverage: Access up to 4x leverage with just 25% upfront capital, without the traditional cost of borrowing eating into your returns during the initial period.

Better Risk Management: The absence of interest charges means you can focus purely on market movements rather than worrying about the clock ticking on your borrowing costs.

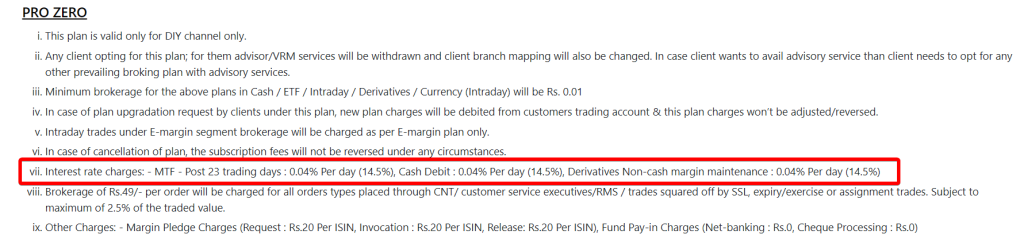

After the 23-trading-day period, interest applies at 0.04% per day, which translates to approximately 14.5% annually. But for traders who typically close positions within a few weeks, this zero-interest window covers most of their trading timeline.

What Else Comes With PRO Zero?

The MTF interest benefit isn’t the only feature of the PRO Zero plan. Subscribers also enjoy zero brokerage on intraday equity trades and futures and options transactions. For active traders, this combination of zero brokerage and zero MTF interest creates a compelling value proposition.

The plan requires a one-time subscription fee of just ₹99, which provides lifetime validity. That’s a remarkably low entry point for benefits that can save thousands in trading costs over time.

Who Should Consider This?

This offering particularly suits traders who:

- Regularly use leverage to amplify their market positions

- Hold positions for several days to weeks rather than pure intraday trading

- Want to maximize returns without interest costs diminishing profits

- Trade actively and want to minimize transaction costs

It’s worth noting that the plan is designed for self-directed traders using the DIY (do-it-yourself) channel. When you enroll, advisory services are withdrawn, putting you firmly in control of your trading decisions.

Important Considerations

While the zero-interest period provides significant benefits, margin trading inherently carries higher risk than cash trading. The leverage that amplifies gains also magnifies losses. If your position value drops, you may face margin calls requiring additional funds, or your broker may square off your position to protect against further losses.

Additionally, you can carry forward MTF positions for up to 365 trading days, but interest charges apply after the initial 23-day zero-interest period. Planning your position duration becomes crucial to maximizing the benefit.

The Bigger Picture

This move by SBI Securities reflects a broader trend in the fintech and broking space: reducing friction and costs for retail investors. As competition intensifies, brokers are finding innovative ways to deliver value, and zero-interest MTF periods represent a meaningful step in making leveraged trading more accessible and affordable.

For traders who understand the risks and opportunities of margin trading, this 23-day interest-free window opens up new strategic possibilities. Whether you’re looking to capture a medium-term trend, take advantage of a specific market opportunity, or simply want more flexibility in your trading approach, the PRO Zero plan deserves consideration.

The integration of zero brokerage and zero MTF interest creates a cost structure that was unthinkable just a few years ago. It’s a reminder that the financial services landscape continues to evolve in favor of retail participants, providing tools and benefits once reserved for larger players.

diy.sbisecurities.in/campaign/pro-zero

sbisecurities.in/terms/e-margin

sbisecurities.in/fileserver/regulation/terms-and-conditions.html