In financial markets, a bid represents the highest price that a buyer is willing to pay for a financial instrument, such as a stock, bond, or commodity. On the other hand, an offer, also known as an ask, represents the lowest price at which a seller is willing to sell the same financial instrument. The bid and offer prices, along with the quantity of the financial instrument available at each price level, are typically displayed in a bid-ask spread, also known as the bid-offer ladder.

Here’s a simpler explanation to get the bid and ask concept:

Imagine you’re shopping on eBay and find a used item you like. The seller has set a price they want for it, called the “offer price.” If you’re eager to buy the item right away, you agree to pay the offered price. This means you’re buying the item at the price the seller is asking for. The buyer is eager to buy and buys in to the seller’s offer price.

Now, let’s say you’re interested in the same item, but you’re not in a rush. Instead of paying the offered price, you try and negotiate for a lower price that you’re willing to pay—this is called your “bid.” If the seller is in a hurry to sell, they might accept your bid, meaning they sell the item to you at your bidding price. The seller is eager to sell and sells in to the buyer’s bidding price.

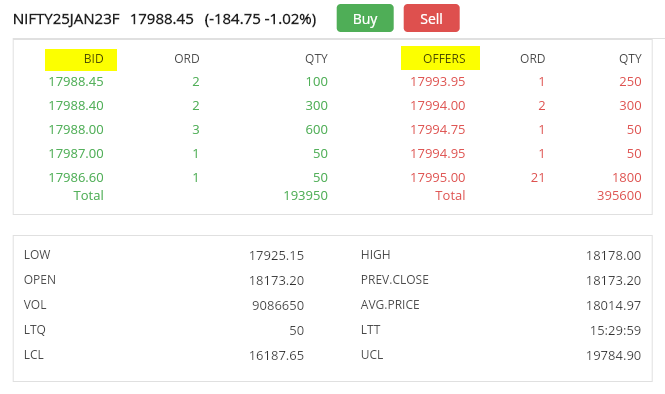

In the above screenshot you will see that the nifty futures contract is trading at a bid price of 17988.45 INR and an offer price of 17993.95 INR. This means that a buyer is willing to pay 17988.45 INR, and a seller is willing to sell it for 17993.95. The difference between the bid and offer is known as the bid-ask spread, which in this example is 5.5 INR.

It is important to note that bid and ask prices are constantly changing, depending on the supply and demand for the financial instrument. The bid-ask spread is typically narrower for liquid assets, or those which are frequently traded and have many buyers and sellers.

How to quickly recall what is what.

One way to remember the difference between a bid and an offer is, the word “bid” starts with b so does “buy,” and the opposite component “offer” is therefore “sell.”

This can help you remember that the bid is the price at which a buyer is willing to buy an instrument, while the offer is the price at which a seller is willing to sell the same instrument.

“Bid is for buy, offer for sell. Remember this well, and you’ll do well.”