Margin Trading Facility (MTF) has emerged as a compelling option for investors looking to amplify their market exposure by leveraging borrowed funds. In 2026, two prominent players in the Indian brokerage landscape, Angel One and SBI Securities, offer distinct MTF propositions, with notable interest-free periods that can significantly benefit traders. Understanding these offerings, their associated costs, and features is crucial for making informed investment decisions.

Angel One’s MTF: Expanding Your Trading Horizon

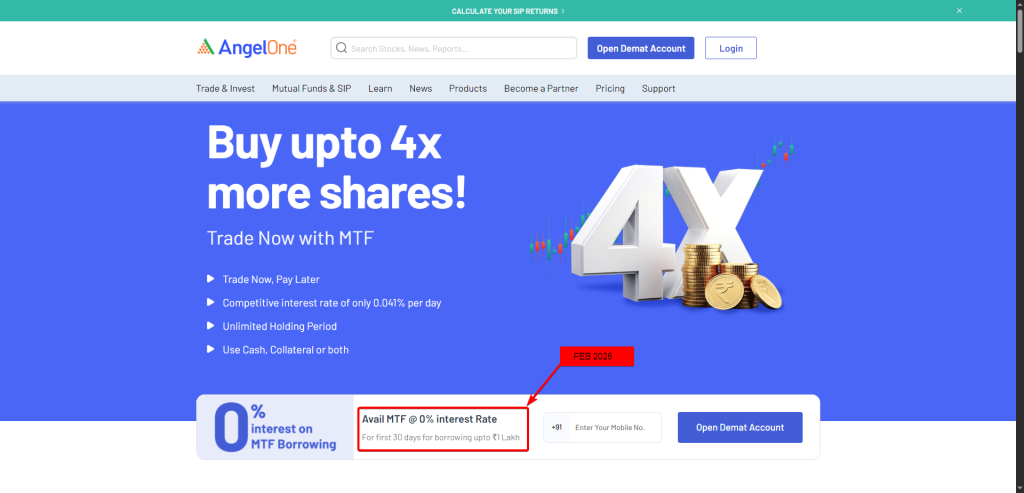

Angel One provides a robust Margin Trading Facility, enabling investors to purchase stocks worth up to four times their available cash balance. This means that for every ₹10,000 you have, you could potentially control stocks valued at ₹40,000. A significant draw of Angel One’s MTF is its interest-free period for the initial 30 days on a wide selection of over 1600 stocks. This feature allows traders to capitalize on short-term opportunities without the immediate burden of interest costs, offering a valuable window for positions to mature.

Beyond this initial period, interest is charged on the borrowed amount, accruing from the day the MTF trade is placed until the day before the position is closed, including non-trading days. It’s also important to be aware of other charges, such as brokerage fees, which can be as low as ₹20 or 0.1% (whichever is lower) per executed order, with a minimum of ₹2. Additionally, pledging or unpledging shares under MTF incurs a charge of ₹20 plus GST per request per ISIN.

Angel One’s platform also allows investors to use existing holdings as collateral instead of cash, with interest applying to the entire purchase value in such cases. The facility is specifically for trading in equity shares. Angel One also offers features like the Smart Super App, integrating AI and Machine Learning for an enhanced digital trading experience, and a “Smart Store” for fintech products and investor education.

SBI Securities’ E-Margin (MTF): Leverage with a Head Start

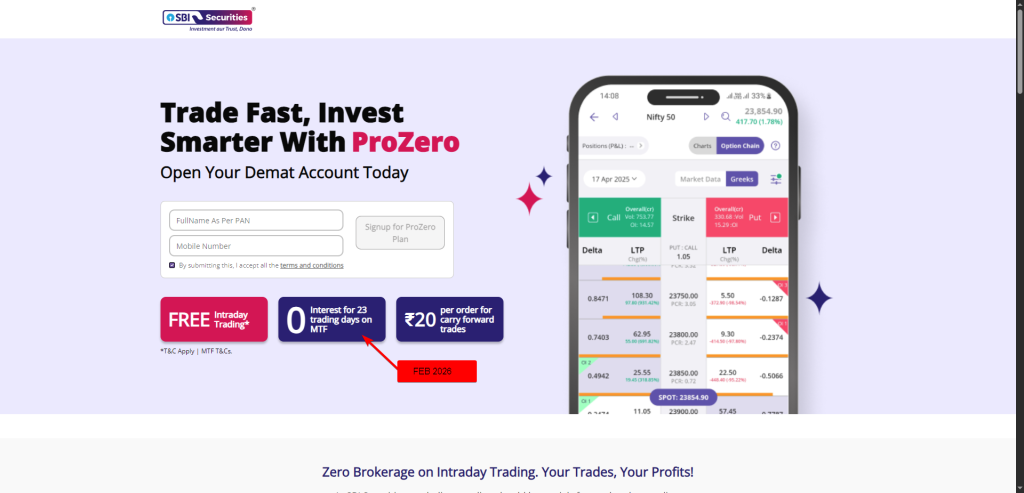

SBI Securities, through its E-Margin product, also offers a Margin Trading Facility that allows investors to increase their buying power by up to four times. This “Buy Now, Pay Later” system requires investors to pay only a fraction, typically around 25%, of the total transaction value upfront.

A key advantage of SBI Securities’ E-Margin is the interest-free period for the first 23 trading days. This means that for nearly a month of active trading, you can utilize borrowed capital without incurring interest charges, a significant benefit for those looking to manage short to medium-term positions cost-effectively. After this interest-free window, interest is applied to the borrowed amount.

MTF positions with SBI Securities can be held for an extended period, up to 365 trading days (approximately 520 calendar days). Investors also receive the full dividend benefit for their E-margin stocks. Brokerage for MTF trades is charged at 0.50% on both buy and sell trades. It’s worth noting that SBI Securities’ “ProZero” plan, while offering zero brokerage on intraday equity and F&O transactions, specifically provides the 0% interest for 23 trading days on MTF as part of its features. This plan typically involves a one-time subscription fee.

Important Considerations for Margin Trading

While the interest-free periods offered by both Angel One and SBI Securities present attractive opportunities, it’s crucial to approach margin trading with a clear understanding of its inherent risks. Leverage amplifies both potential gains and losses. Should the value of your position decline, you may face margin calls, requiring additional funds, or your broker might square off your position to mitigate further losses. SEBI regulations govern margin trading, providing a framework for investor protection. It’s always advisable to maintain sufficient margin and be aware of the terms and conditions set by your broker.

Both Angel One and SBI Securities offer compelling MTF options in 2026, with their respective interest-free periods providing a strategic advantage for traders. By carefully evaluating their features, charges, and aligning them with individual trading strategies and risk tolerance, investors can effectively utilize these facilities to enhance their market participation.

Important Disclaimer: Please note that the landscape for Margin Trading Facility (MTF) products is subject to continuous evolution due to regulatory changes. The Reserve Bank of India (RBI) issued significant directives in February 2026, effective April 1, 2026, aimed at strengthening the norms for credit facilities extended to capital market intermediaries like stockbrokers. These changes include mandating 100% secured lending to brokers, implementing stricter collateral requirements for bank guarantees (with a minimum of 50% collateral, 25% of which must be cash), and prohibiting bank funding for proprietary trading. While client MTF remains allowed, these revised norms could potentially impact the funding costs for brokers, potentially leading to adjustments in MTF offerings, interest rates, or leverage multiples provided to clients. Therefore, the specific offers, interest-free periods, and associated terms mentioned for Angel One and SBI Securities in this article are subject to change. Readers are strongly advised to visit the official websites of these brokers directly to confirm the most current and live offers before making any investment decisions.